They are getting clever, scammers are targeting vulnerable people by sending out letters to seem more official. Do not get fooled and have a conversation with vulnerable adults in your life that may not see the internet warnings about this scam.

HOW TO TELL THE LETTER YOU HAVE IS LEGITIMATE:

The Forbes Website writes:

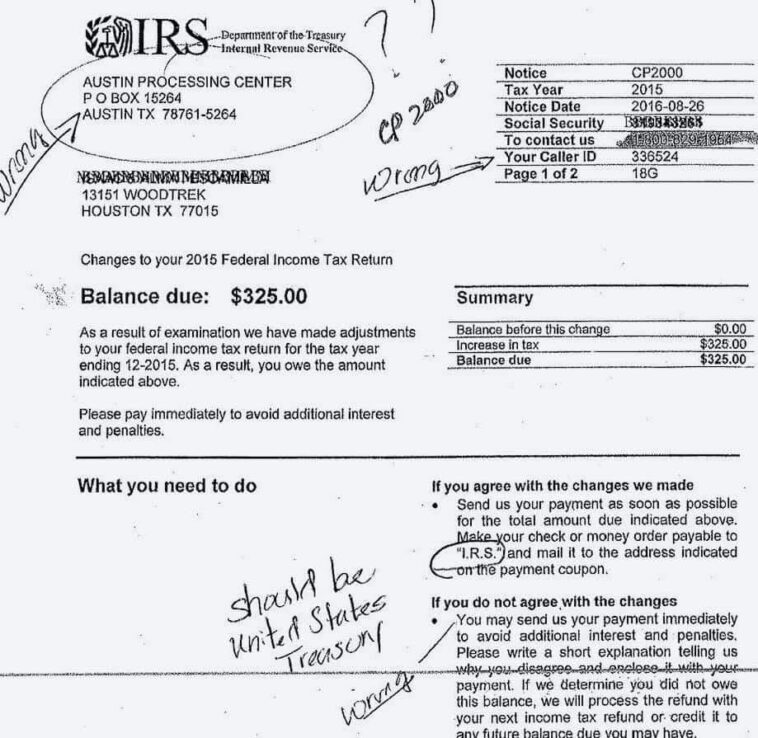

“A proper IRS letter will usually arrive in a government envelope and will include the IRS seal on the notice or letter.

A legitimate letter will include a notice or letter number, most commonly found at the top right-hand corner. If there’s no notice or letter number, it’s likely a fake.

A real IRS letter will typically include your truncated tax ID number and will note the tax year or years in question at the top right-hand corner of the letter.

A bona fide letter will include IRS contact information – usually a 1.800 number found at the top of the letter near your identifying information. If there’s no contact information or if it appears to be a personal or cell number, the letter is likely a fake. If there is contact information but you’re not sure that it’s legitimate, you can always call the IRS directly at 1.800.829.1040.

A letter from the real IRS will also include additional information about your rights as a taxpayer (thanks, Nina Olson) such as Publication 1 (downloads as a PDF) or an explanation of your appeal rights and other options. The real IRS will not threaten to arrest or deport you.

Finally, a legitimate collection letter will note your payment options, including how to pay any balance due. If the letter asks you to write a check to any party other than the U.S. Treasury, furnish credit or debit card information over the phone, or to pay using iTunes or other gift cards (more on that here), it’s a fake.”

This post was created with our nice and easy submission form. Create your post!